Indonesia’s coal exports surged during 2022, with the EU and India receiving the lion’s share of these increases. In its latest weekly report, shipbroker Banchero Costa said that “after a slow start in the first quarter, global coal trade has really picked up pace last year, and is now fully back to pre-Covid levels. In the full 12 months of 2022, total global seaborne coal loadings increased by +5.9% y-o-y to 1204.9 mln t (excluding cabotage), from 1138.3 mln t in the full 12 months of 2021, although still below the 1275.6 mln t in Jan-Dec 2019. As already mentioned, the worst was at start of the year, and the trend in recent months has been increasingly positive. In 1Q 2022, global loadings were down -4.8% y-o-y to just 257.4 mln t, and down -20.3% from 1Q 2019. In 2Q 2022, coal loadings were a strong +8.5% y-o-y at 313.8 mln t, and down -4.1% from 2Q 2019. In 3Q 2022, shipments increased again to 317.2 mln t, up +6.3% y-o-y, and just -0.7% from 3Q 2019. In 4Q 2022, loadings were 316.5 mln t, up +12.9% y-o-y from 4Q 2021, and -0.6% from 4Q 2019”.

According to the shipbroker “in Jan-Dec 2022, exports from Indonesia increased by +21.2% y-o-y to 388.9 mln t, whilst from Australia down -5.0% y-o-y to 340.3 mln t. Seaborne coal imports into the European Union surged by +33.9% yo-y to 116.5 mln t in Jan-Dec 2022, whilst imports to India increased by +13.6% y-o-y to 203.8 mln t, and imports to China declined by -3.2% y-o-y to 234.7 mln t. Indonesia is the world’s largest seaborne exporter of coal, accounting for 32.3% of the global seaborne coal market in 2022. Export volumes from Indonesia were relatively depressed during 2020 and 2021, due to disruption from Covid19 and from government policies favouring domestic consumption, but bounced back to an all-time record high in 2022”.

“Total seaborne coal exports from Indonesia in the 12 months of 2022 reached 388.9 mln tonnes, according to Refinitiv vessel tracking data. This was up +21.2% y-o-y from the 321.0 mln tonnes of 2021, and +25.4% from the low of 310.3 mln t in 2020, and also +0.7% from the previous record 386.2 mln t in 2019. The vast majority of Indonesian coal exports are loaded in East Kalimantan and South Kalimantan (the island of Borneo), with some volumes also shipped from southern Sumatra island.

The main coal export terminals in Indonesia are: Taboneo/ Banjarmasin (78.1 mln t loaded in Jan-Dec 2022), Samarinda (74.2 mln t), Tanjung Bara (32.1 mln t), Muara Banyu Asin (30.7 mln t), Balikpapan (27.5 mln t), Bunati (25.6 mln t), Adang Bay (21.8 mln t), Muara Pantai (21.4 mln t), Pulau Laut (15.3 mln t), Tarakan Island (9.7 mln t), Muara Satui (8.5 mln t), Bontang (8.1 mln t), Tarahan (8.0 mln t), Tanjung Pemancingan (7.8 mln t), Muara Sabak (5.9 mln t). The majority (57%) of coal volumes from Indonesia are loaded on Panamax vessels, with 26% on Supramax/Handymax vessels, and just 15% on Capesize tonnage. Trade patterns for Indonesian coal exports saw significant shifts in recent years”, the shipbroker said.

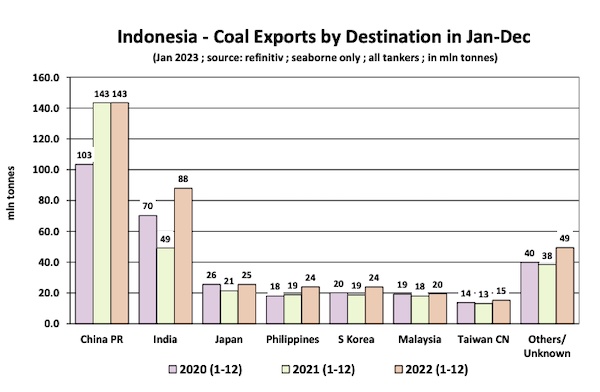

“China continues to be the top importer of Indonesian seaborne coal exports, accounting for 36.9% of shipments In Jan-Dec 2022, shipments from Indonesia to China were flat +0.0% at 143.5 mln tonnes, following a huge +38.6% y-o-y jump in 2021. About 22.6% of exports, or 88.0 mln tonnes in 2022, were shipped to India, representing an increase of +78.9% y-o-y from 49.2 mln tonnes in 2021, but still below the 91.5 mln tonnes shipped to India in 2019. Shipments to Japan have also rebounded, increasing by +19.2% yo-y to 25.5 mln tonnes, with Japan accounting for 7% of Indonesian exports. The Philippines imported 23.9 mln tonnes of coal, up +27.2% y-o-y, with the Philippines accounting for 6%. Exports to South Korea increased as well by +27.8% y-o-y to 23.9 mln t. Malaysia received 19.5 mln tonnes, an increase of +8.5% y-o-y. Last but not least, exports to Taiwan increased +16.3% y-o-y to 15.3 mln t”, Banchero Costa concluded.